We aspire to take impact investing to the next level.

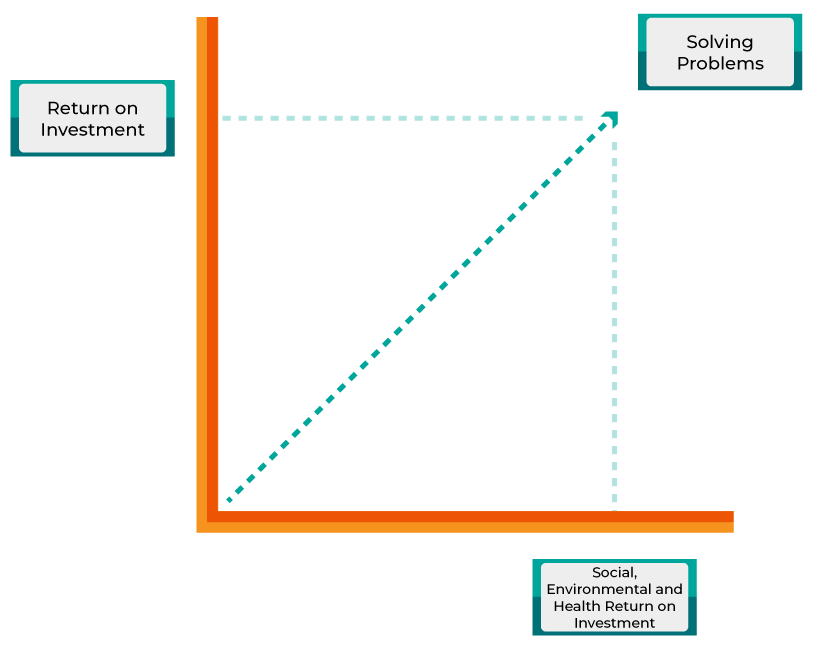

We invest in fast-growing tech startups solving the root causes of the world’s greatest social, environmental and health challenges and at the same time creating profitable businesses.

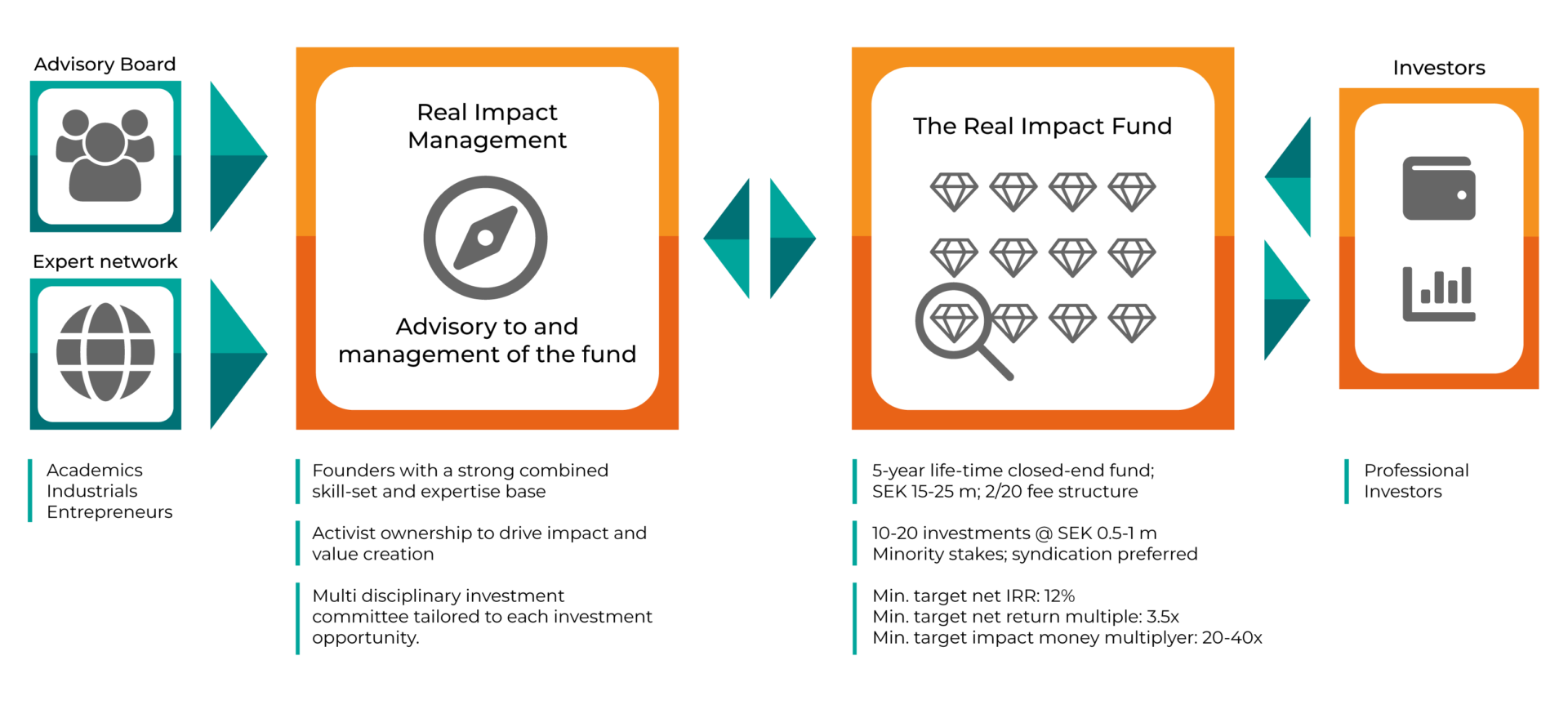

The Real Impact Fund in brief

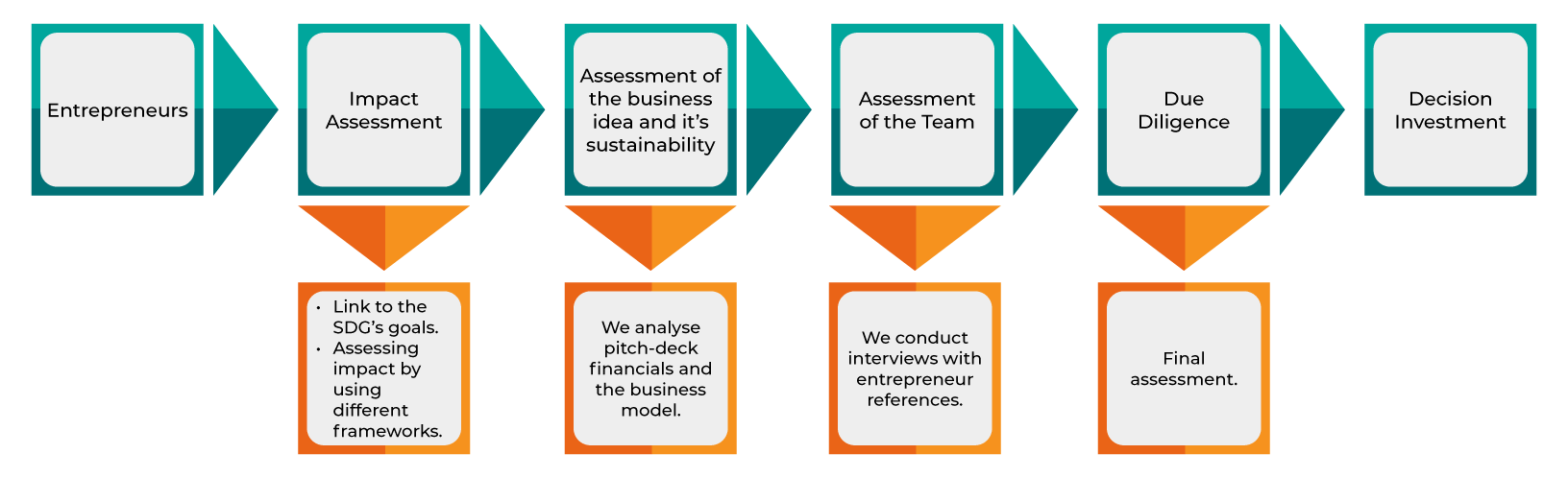

The fund will invest in early-stage impact start-ups based in the Nordics and internationally. Entrepreneurs that have business ideas, ambition and capacity to start and run an impact company.

We classify our investments in accordance with the UN Sustainable Development Goals, SDGs and apply evidence-based models to assess impact creation . The fund offers competitive financial returns, provide resilience and attractive measurable social and environmental impact alongside a competitive financial return.

We will implement a sector-agnostic approach with regard to our investments

Why

At The Real Impact Company, we believe in the power of innovation and entrepreneurship to address global challenges.

However, early-stage impact ventures require crucial support, yet there is a significant market gap. In Sweden, the Nordics, and internationally, there are few, if any, dedicated impact funds that specifically focus on supporting innovative impact startups at the early stage.

Our goal is to revolutionizing impact investing. Join us in this transformative journey, where investors and entrepreneurs like you can make a real impact.

Tenants of Impact Investing

Intentionality

An investor’s intention to have a positive social, environmental or health impact through investments

Investment with return expectations

Impact investments are expected to generate a financial return on capital or, at minimum, a return of capital.

Return expectations and asset classes

Impact investments target financial returns from below market to risk-adjusted market rate, and can be made across asset classes (e.g., fixed income, venture capital, and private equity).

Impact measurement

The investor is committed to measure and report the social and environmental performance and progress of underlying investments, ensuring transparency and accountability.

How

We manage an investment fund that focuses on early-stage impact startups in the Nordics.

We operate a lab aimed at developing scalable impact business ideas. These ideas are tested using Minimum Viable Product methodology.

We offer business advice on impact measurement, innovation, and resource mobilization to companies and organisation.

Our Focus

We invest in entrepreneurs who:

- Create a positive social, health, economic, or environmental impact,

- Utilize technology to address challenges,

- Demonstrate the ability to scale their product or service,

- Exhibit commitment and persistence,

- Possess financially viable business concepts.

About impact investment

Our goal is to invest to tackle the root causes of societal and environmental challenges by leveraging disruptive technology as enabler and catalyst to create lasting behavioural change.

Thereby we can achieve triple bottom-line and competitive financial returns.

Portfolio

We run an investment fund, a lab and we provide business advice on impact.

The lab

Here you’ll find information about the ideas we are currently working on within our lab.

The fund

Here you find investments made by the fund.

The fund will commence its operations in October 2023.

We will publish information as investments are made.

Impact business advice

We have supported a number of companies and organizations with their impact work. Here is a selection of customer cases:

Tillväxtrådgivningen:

https://ngofactory.nu

Restart Earth Foundation

IUFRO World Congress:

https://iufro2024.com

About Us

We have 30 years of experience in finance, innovation, business law and leadership, combined with 15 years of expertise in impact entrepreneurship.

We take pride in offering a unique combination of knowledge and experience in these areas to create a leading investment fund, lab, and consultancy in the field of early-stage impact entrepreneurship and investment.

The Founders

Anna-Lena Hernvall

Chair

Founder, Leadership and

communication

Experience as an executive

at multiple companies.

Carl-Viggo Östlund

Founder

Senior management experience financial sector

Former CEO Nordnet and SBAB (Banc)

Ulf Dubois

Founder, Sales and Business Development

Experience as CEO and Sales Director in multiple companies.

Advisors

Prof. Sheila Tlou (Botswana)

Advisor

Former UNAIDS Regional Director and Minister of Health Botswana

Peter Åberg

Advisor

Appointed to Supergasell 2022. The fastest growing company in Sweden.

Leadership and sustainability expert with ISO certifications for municipal corporations.

One of ALMI’s sustainability experts in

Sweden, as well as the UN-Stockholm chairperson supporting sustainable business solutions.

Yankuba Daffeh (Gambia)

Advisor

Former business developer Jönköping Science Park, partner NGO y AB

Joaquin Cestino (Spain)

Advisor

Assistant Professor

Business Administration

Jönköping International Business School, JIBS

Karl Johan Bonnedahl

Advisor

Associate professor

Business administration

USBE, Umeå university

Sustainability expert with impact management and social innovation as focus areas

News

Read the latest news on our LinkedIn page.

Contact

Rodrigo Garay

+46-70-6319307

Visiting Address:

The Park Södra

Magnus Ladulåsgatan 1

Stockholm

Administrative Address:

Västmannagatan 38, 113 25

Stockholm